Green copper is going to play a critical role in enabling decarbonization.

Copper is an important raw material for the electronics industry, being the most widely used conductor for PCB, wiring, and connector manufacturing. The average person, however, might not realize this, thinking that copper is some kind of old metal on which there is no progress to be made.

Over the next few years, we will be using more and more copper, due to the growing demand for this material in the production of electric vehicles (EVs). EVs use four times as much copper than an internal combustion engine vehicle, and copper is used ten times more by weight in an electric vehicle than lithium, which is a rare material. Analysts predict that by 2050, the accelerated demand for copper will reach 130 Blbs per year, double the current demand (see Figure 1). As older producing copper mines continue to deplete their resources, there are few new copper discoveries.

Copper and clean energy

Decarbonization can be seen as part of the cost of fighting climate change, or at least slowing it down. The purpose of decarbonization is not just to halt climate change, but also to achieve a higher level of efficiency. Electric vehicles, of course, tie into that messaging, since they are an integral part of it. However, there are other relevant aspects, such as reducing our dependence on plastics, reducing chemicals in general and pollutants, reducing our usage of all types of materials and becoming more efficient and less wasteful. EVs can bring efficiency by centralizing the power source and power production. And then, if you can make that power production greener, you can get even greater efficiency gains.

Copper will play a critical role in the transition to clean energy. Clean energy technologies are becoming the fastest-growing segment of copper demand, including applications such as wind turbines, solar panels, EV batteries, and large-scale energy storage.

How World Copper meets copper demand

World Copper Ltd, a mineral resource company focused on the development of copper assets, has market experience gained through the history of mining operations accumulated by its board of directors and management.

“We don’t invest in the usage of copper, or in how we can use it more efficiently, we are investing in supplying the world’s demand for copper,” said Nolan Peterson, CEO of World Copper.

Higher grade mines are becoming harder to find. The average grade mined by the top 15 producers has decreased from 1.20% to 0.72% Cu in this decade, and it’s becoming more expensive to produce copper now than it ever was in the past.

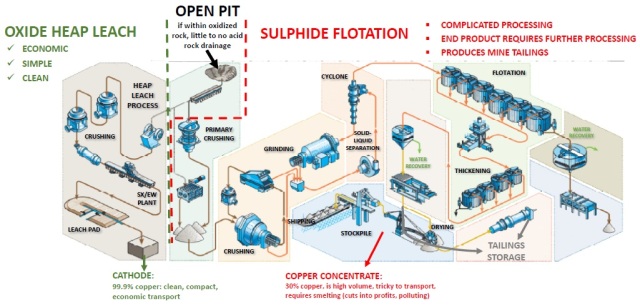

What differentiates World Copper from other mining companies is how the mineral is extracted. The deposits which produce the vast majority of the world’s copper are using a process called sulphide flotation, which is a complicated process and uses a lot of water and generates greenhouse gases. World Copper, however, is using another method for copper production, called heap leach copper oxide.

“We can produce copper cleaner and greener than any other source of copper in the world,” said Peterson. “Not only are we an oxide project, but we also have the benefit of a project using gravity, since it’s located at the top of a mountain, and Chile is a country leader in renewable power.”

As shown in Figure 2, sulphide process requires very large equipment and workforce, uses a lot of water, and the output product is a concentrate, not pure copper. According to World Copper, oxide heap leaching, the other way around, is currently one of the cleanest ways to make copper. Today, 70% of the world’s copper comes from the first method, while the remaining comes from oxide heap leaching.

Peterson believes, as people begin to care more about electrification and decarbonization, they will look for that greener copper and promote its development. And if that means paying a little bit more to say that their supply chain is green, he thinks that many manufacturers will go down that road.

Copper production from oxide heap leaching costs one-third that of sulphide flotation, and no smelting process is required to produce copper cathodes as the energy consumption of the process is lower overall. Smelting is a process that takes copper concentrate ore, and uses what’s called pyrometallurgical technology to basically roast the ore at a very high temperature. This process usually requires a fossil fuel of some sort to get that temperature high enough, and once it does that, it releases sulphur and other chemicals into the air. On the other hand, copper oxide uses electrowinning, which basically uses electricity, in place of the smelting operation.

“Right now, we are in the planning stage, developing our property, and picking the appropriate techniques and technologies,” said Peterson. “We’re years away from operations, but we will be contemplating the use of technologies like regenerative brakes, for example, on our mining vehicles and potentially hybrid type vehicles, as a couple of examples of technological solutions that will enhance our project.”

What OEMs are looking for is 100% pure copper. They don’t necessarily want finished products, because they finish them themselves. What customers are looking for is the green aspect of copper which entitles them to say that copper was produced in the greenest and cleanest manner possible. And that entails using what is called grade A cathode, the end-product of the oxide heap leach process (see Figure 2).

World Copper is currently developing the Escalones project near Santiago. Escalones is Chile’s largest copper oxide deposit under exploration and development, with three and a half billion pounds of copper mineral in the ground. The company is currently working on a preliminary economic analysis that will help it present the development of that asset to the market and encourage investment as the project progresses. World Copper is also investing in Arizona in a project called Zonia. This is a copper oxide project, and it plans to shortly begin the permitting process and to bring it into operation. With 500 million pounds of copper, Zonia is smaller, but less expensive and faster to develop.

“We are pushing forward on these two projects. We are probably three or four years away from development, or from construction and operations at the earliest. However, we think it is a good time to invest because we are undervalued in the market for the assets we have and the quality of their development potential,” said Peterson.